Like most Americans, you have experienced times when a little more cash might have made all the difference. We have all been caught off guard by unanticipated medical costs, tuition fees, auto repairs, and property maintenance. It is expensive and unpleasant. These fees or the rapid cash loans you need could worry you if you don’t have much money in savings.

If this is your current circumstance, you’re definitely considering a wide range of alternatives and lenders in order to get some quick cash. Today, there are several options for getting the money you need, from internet lenders to traditional brick-and-mortar organizations. As a last resort, you might take out a loan, add more hours to your current employment, or launch a side business to increase your income. If none of these choices are available to you, you can think about getting a payday or fast cash loan. Even though you may be able to get the money you need right away from these lenders, there are a few factors to keep in mind while searching for rapid cash loan alternatives.

Whether you need a payday loan or a quick cash loan, OakParkFinancial can guide you through the procedure online or in person. Read on to find out how OakParkFinancial can support you regardless of your financial status or credit rating.

What Is a Payday Loan Defined As?

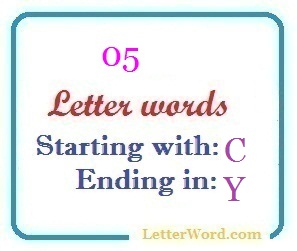

You must first comprehend what a “fast cash loan” is before you can start your journey. This is a general phrase that covers a wide range of lending products and lenders. You’ll need to do extensive study to determine which of the available possibilities is the greatest fit for you if you want to get a loan.

A short-term personal loan product that swiftly disburses cash to the borrower after approval is one of the most common definitions of a “rapid loan.”

A fast cash loan goes by many names, so even if you’ve used one before you may not have recognized it. But the vast majority of these loans are for private purposes. They are more likely to be used for personal than for business costs. For a variety of reasons, including several that are mentioned below, borrowers often look for quick personal loans:

- Mechanics are required for vehicle repairs.

- Repaired mechanical and electrical systems on your property.

- what it costs to educate a child.

- the price of receiving medical care

- purchases made only for private purposes

- the price of a funeral for a loved one.

- shifting costs

- additional unforeseen costs that might arise.

Payday loans and other short-term loans sometimes have quick payback terms. The length of a quick cash loan’s payback duration may range from a few weeks to several months, depending on the loan type and loan amount. Numerous circumstances might lead someone to want a quick cash loan.

How to Obtain a Cash Advance Quickly

In many ways, asking for a short-term loan from a typical bank is like applying for other types of loans. To get started, you must fill out an application. The procedure of applying for a fast cash loan has been substantially expedited with the introduction of online applications. Always verify if you may submit an online application on the lender’s website. You may apply for a loan online quickly and obtain money as soon as you can with many lenders. Many people who need money quickly choose to apply for loans online.

Most lenders need customers to visit a physical store to apply for loans in person since there isn’t an online application option. Look for a lender with an online application, like OakParkFinancial, if you don’t want to wait in line or fill out a lot of paperwork. Every application you submit will ask for a lot of details about your financial situation. It’s possible that lenders that don’t need a lot of personal information are saying that they will profit more if you don’t pay back the loan.

You will be informed as to whether your application has been accepted or rejected when the lender has received and processed it. If you are accepted into the program or not depends on a number of variables. Lenders may sometimes request details about your current work and income, as well as your credit history, loan amount, and current bank account information. Your credit score may be harmed by credit card and other loan debt, and lenders may have doubts about your ability to repay if you have a lot of debt.

You often have a grace period before reapplying for a loan if your first application is denied. If your financial status doesn’t drastically improve, it’s improbable that the same lender would approve you once again. A fast cash loan lender will ask you to sign a contract outlining all the terms and conditions, including the interest rates and costs, after approving you. To make sure you are adequately prepared for your encounter, please read this whole document. Only apply for online cash loans if you are positive you will be able to pay them back.

Upon receiving the lender’s approval, you will get the monies. Many lenders will use direct deposit to put money into your account right away. as it is the simplest method to get money from a bank or other lending organization. Once you get the funds, you are free to utilize them for financial or personal obligations. Making loan payments in accordance with the predetermined due dates outlined in your contract is the next step. The contract expires when the debt is fully repaid.

What You Should Know About Title and Payday Loans

There are many different types of short-term loans available nowadays. All loans, whether they are obtained online or in person, have different interest rates, terms, and conditions. Similar to that, you must comprehend their intricacy and differences in order to get the ideal quick cash loan. An overview of the most popular kinds of short-term loans is provided below:

How to Get a Payday Loan The term “payday loan” refers to a modest loan taken out by borrowers during tough financial situations or to help them get by until their next paycheck. There are no limits on collateral, thus lenders may depend merely on the borrower’s pledge to pay back. Payday loans often have short terms and range in amount from a few hundred dollars. Credit checks may be required of borrowers with subprime (poor) credit as part of the application process, which might lead to exorbitant interest rates. Remember that a variety of credit checks might affect your credit score. This is a short-term loan that could be more detrimental to your finances than beneficial. Going to a bank or credit union may not be the best course of action.

Another kind of short-term loan for fast cash is a title loan. Contrary to payday loans, title loans require the borrower to forfeit their car as security in the event that they are unable to pay back the loan. You may be able to sell the car for a lot of money if it is valuable. But if you don’t pay back your loan, your lender could seize and sell your car to make up for their losses. Care should be taken while taking out title loans since the quick cash they provide may not be enough to offset the danger to your automobile.

Payday and title loans aren’t the only options available to those with terrible credit; unsecured personal installment loans are a viable alternative. These loans allow borrowers to get more money (up to a few thousand dollars) and spread out their payments over a longer period of time. Compared to personal installment loans, payday loans can feature higher interest rates. Here is a fantastic place to start since personal loans could be more cheap than payday loans. Compared to payday loans, they are short-term loans that are less hazardous and more cheap. You may find several of these lenders online.

What Makes OakParkFinancial the Best Choice for Short-Term Cash Flow?

With a personal installment loan from OakParkFinancial, you may quickly get the money you need to take care of your current financial obligations. We protect your privacy and provide a completely online application process, a direct deposit into your bank account, and straightforward online payments. With OakParkFinancial, there’s no need to leave the comfort of your own home. Whether you need to make some payments, fix your car, or save money until your next paycheck, OakParkFinancial can be your best choice for finance.

To regain control of your money, apply for a personal installment loan with OakParkFinancial right now.

Author bio

Taylor Day

Personal Finance Writer at Oakparkfinancial

Taylor Day is an expert on personal finance. She covers everything from personal loans to student loans and general financial issues. Her work has been featured on the top-rated media outlets like Time, CBS News, Huffington Post, Business Insider, AOL, MSN, and many more. Taylor is fascinated by finding new ways to earn extra cash. Her favorite is a guy who made 600 dollars a month selling crickets on the internet. She writes about saving, investing, and finding ways to fund college without loans.