The Indian economy experienced a slowdown earlier in the year. This has been addressed by the central government. There was no improvement. The economy has been further hampered by the Corona virus’s nationwide fighting and stagnation.

This announcement is made as April 10th marks the sixth day of the merger of the 10 state-owned banks. Due to the increase in non-performing loans (NPAs) and the rise in high-profile industrialists who have taken money from the bank, the banking sector is currently in bankruptcy.

According to reports, the central government made the above decision in the belief that merging small banks with low NPAs and large banks would improve the economy. The reality is quite different. The loss of their jobs is causing anger among bank employees and they are protesting the merger.

On the other hand, the finance ministry has stated that no employees will be hired. It is difficult to see how profits can be made and the bank’s capacity increased if such a decision is made. “It was just something that came to our attention then.

If the bank situation is not improved by those who have given undeserved favors to incompetent landless people in the merger process, it will be permanent. The allegations have not been confirmed by the finance ministry.

Karona is a strong voice in the Indian economy, even though it’s going through a tough period. The bed is under pressure. Looking back at the past, the actions of ‘Jesse Bank are becoming more prominent. It may prove difficult for the bank’s account holders to get their money back depending on how large they are.

If there are only a few banks, this may reduce the option to deposit money. People don’t believe that it is possible to overcome an abnormal situation by keeping all their money in one bank, and depositing it in other banks.

Advocates for bank mergers argue that banks owned by large states can compete with private banks. Large banks are able to lend more. It is possible to predict that people such as Modi and Mehul Chosi who extorted money at the Punjab National Bank (PNBB) could also be benefited by the intervention of politicians, bureaucrats, and bureaucrats.

It would be false to claim that banks offer unusual loans because of political interference. Politicians and high-ranking officials of the central government’s financial ministry have always intervened. Even more dangerous is when high-ranking officials plot to rob their bank, starting with employees of bank branches. The general depositor didn’t have a guardian at that time.

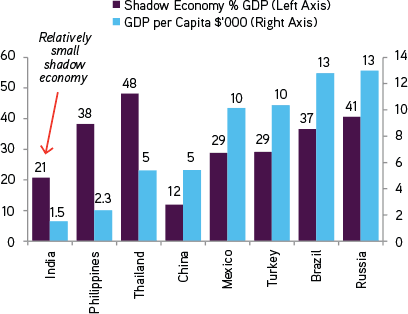

This backdrop can help make it easier to commit big bank robberies. Because the left-hander isn’t aware of what the right-hand is doing in a large organization. Small banks are more secure for depositors.

Also see: For The Younger Ones

However, the constant replacement of the Head of the Reserve Bank of India(RBI), who manages India’s banking system, and the fact there are still differences within the central banking continue to undermine the bank sector’s morale. The net worth of the state-owned banks is Rs 9.28 lakh crore, and only NPAs have this much. If the bank merger fails, this will put the banking sector in serious financial trouble.

Since NarendraModi took office, there has not been any positive change in India’s economy. During the by-elections, India’s gross domestic product was in good condition. It was felt by the public as well. Modi’s government was hit hard by financial reforms but it has not been defeated.

The plan to create four large banks including 10 state-owned banks is currently under discussion. The government failed to de-regulate, introducing GST, and now managing covid-19 are two examples of failures.