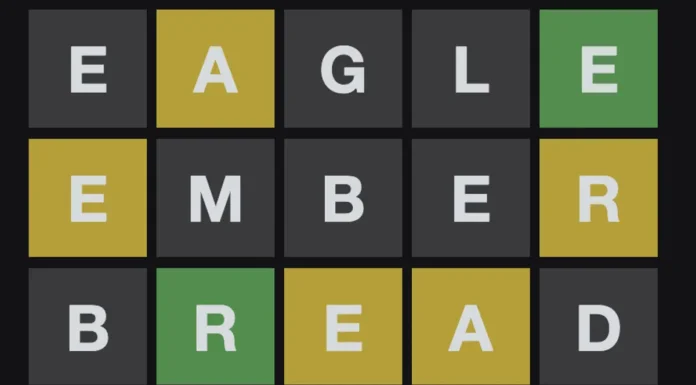

When you’re ready to buy a home, the last thing you want is for your loan to be denied. Fortunately, if you have been approved for a loan in principle, this is one worry that you can put to rest.

A loan in principle is a lender’s commitment to lend you a specified amount of money for a mortgage. This amount is based on your financial situation, including your income, debts, and credit score. While it’s not a guarantee that you will be approved for the full amount when you apply for a mortgage, it does show that the lender is willing to work with you.

If you’re thinking of buying a home, it’s a good idea to get a loan approved in principle before you start looking at properties. That way, you’ll know how much you can spend, and you will not waste your precious time searching for homes that you cannot afford.

When you’re ready to apply for a mortgage, the lender will need to confirm your financial information and run a credit check. If everything looks good, you should be approved for the loan.

To apply for a loan in principle, you’ll need to fill out an application with your lender. Ensure that you provide accurate information so that the lender can make an accurate decision because any discrepancies could result in your application being denied.

It’s also a good idea to shop around and compare rates from different lenders before you apply for a loan in principle. This way, you can be sure that you’re getting the best deal possible.

Once you’ve been approved for a loan in principle, you can shop for your new home with confidence! Just remember to stay within your budget and don’t overextend yourself financially because you don’t want to end up in foreclosure.

If you’re not sure whether or not you’ve been approved for a loan in principle, contact your lender and ask. They should be able to give you an answer right away. However, keep in mind that a loan in principle is not the same as a mortgage approval.

A loan in principle simply means that the lender is willing to lend you money based on the information you have provided. You will still need to go through the mortgage application process and provide additional documentation, such as proof of income and employment before your loan is approved.

Similarly, a loan in principle is not the same as a pre-qualification like an online payday loan. A pre-qualification is based on a cursory review of your financial information and is not as comprehensive as a loan in principle.

Conclusion

Getting a loan in principle is a good first step when you’re ready to buy a home. It will give you a better idea of how much money you can borrow and will help to make the home buying process go more smoothly. Remember, a loan in principle is not a guarantee that you will be approved for a mortgage, but it’s a good indication that the lender is willing to work with you.