Even though crypto trading presents multiple avenues for generating income, crypto holding is among the most profitable businesses. As you exchange, you will speculate the price will fall or rise with no trouble. Consequently, you will yield maximum returns while leveraging the price fluctuations in the market. Fortunately, most trading platforms have various features to allow you to make informed choices and trade. Through that, you improve your odds of producing impressive income and reducing the associated volatility risks of cryptocurrencies. Read on for comprehensive information about the advantages of crypto exchange.

Leverage price shift

The crypto market is marked by sudden price fluctuations across different trading platforms, leaving many investors more attracted to the investment. The shifts add to the exciting part of most investments in digital currencies despite the risks involved. On the flip side, you will capitalize on yielding more profits after properly researching to understand what you should know. Entering such a trade without the informed perspective, as dan hollings the plan reviews will make you lose your entire investment in the shortest cycle of your trading.

Unrestricted trading time

One of the most unique crypto trading aspects is subject to its indefinite hours. The lack of restrictions allows you to exchange round the clock while yielding your profits at your convenience. However, you can achieve this once you identify the most active trading hours to maximize your profits. Based on your jurisdiction, ensure you explore the most suitable time for your crypto holding trades. This understanding will leave you with the knowledge of the down periods you must avoid lowering the chances of losses.

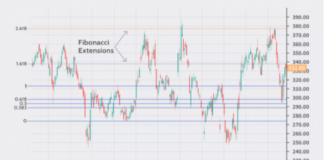

High liquidity

As long as your select trading platform conducts in-depth research on the industry and shares the likely prices, you will enjoy better liquidity in crypto trading. With this information, you will trade quickly and without worries at the least cost. Besides, liquidity is linked with better pricing, faster transactions, and more precise technical analysis. Consequently, you will trade with minimal risks while generating profits quickly. However, being a crypto starter may make trading not your thing, since you can avoid incurring losses or minimize your risks after thoroughly studying your trading environment.

Short or long options

Whenever you buy a cryptocurrency, your only hope is to have price hikes for you to generate higher profits after selling. Consequently, you leverage sudden price shifts for quicker profit-making in the long run. The knowledge gathered allows you to manage the platform’s trading features as you avoid losses and maximize your odds of winning.

Simpler account opening

Crypto trading does not need an account for buying and selling crypto. However, all your exchanges get executed on your behalf, relieving stress. Against such a backdrop, you will only be trading and withdrawing your income in your select currency or fiat currency from your portfolio. Even so, crypto trading on an online platform saves time, increasing your chances of earning profits quickly.

Conclusion

While crypto trading allows you to generate returns quicker, you should explore and know the procedures. One reason is that the simplest mistake will wipe out your earnings. Even if you have mastered this game or are new, you will generate higher returns whenever your trading is done well. On the other hand, if you check with Dan Hollings, the plan reviews, you will understand how to increase your likelihood of winning in your crypto trading anytime. Failing to exchange cautiously makes it hard for you to generate more profits, thereby risking your investments.