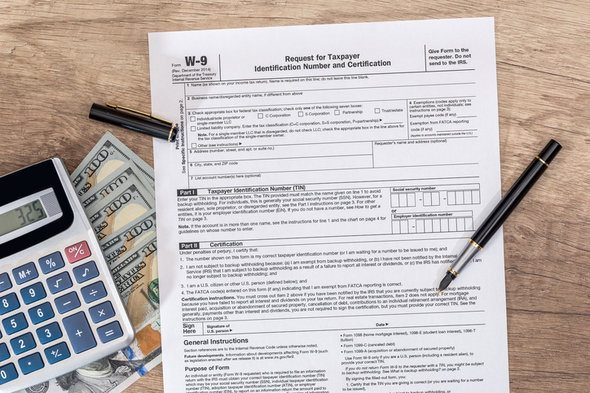

The next research on W9 2022 Form will advice the meaning, procedure, good reasons to fill this type through the individuals.

Are you currently a citizen? If you’re a citizen, you’ll want learned about the W9 form. So if you’re not aware of the form and why it’s used, this publish is perfect for you. Many people within the U . s . States learn about this type, even though many individuals are not aware from the W9 2022 Form. So, if you’re one of these, please look at this article up until the finish.

This information will show you on why this type can be used and when it’s issued. So, should you face any issue while completing your W 9 form, please make reference to this publish.

About W9 form

The W9 form is needed to supply the right TIN (Citizen Identification Number). So if you need to file the data using the IRS and obtain the right TIN, you have to complete this type. This type could also be used to verify the taxpayer’s real name, address, along with other important details like TIN.

Where you’ll get W9 2022 Form?

You can go to the state website people Tax, and you’ll get multiple options combined with the W9 form. You are able to complete the shape very easily.

Who insists upon complete the W9 form?

Anyone or business may request you to match the W9 form needs. If they’re having to pay you for the work, it might be essential to provide every detail, and also the requester isn’t under any obligation to file for the W 9 form. The individual could use this type to satisfy other needs or fill other IRS forms like 1098 forms, etc. The W9 2022 Form can be used to collect the private information needed by company you train with.

Critical Points of W9 Form

This type is needed through the business that should pay their workers to gather their private information like name, address, TIN. They might include people like freelancers, vendors, contractors, etc.

If you’re operating a business with another enterprise, they might desire a W9 form to check on your data like address, citizen security number, name, along with other valuable details.

One more reason to file for a W9 form is when you’re active in the most taxed transactions that should be recorded and reported using the IRS.

W9 2022 Form doesn’t have deadline, but the majority of the tax forms started from The month of january 31, 2022.

How you can complete the W9 form?

First, you have to enter your company name. If filing a sole proprietor, go into the LLC name.

If filing like a business, enter your company name.

Pick the appropriate federal tax classification.

If you’re filing as a person, you don’t need to fill the exemptions.

Other details that should be completed are address, Zipcode, star, account number, citizen identification number.

Finally, you have to approve every detail.

Conclusion

Overall the information around the W9 2022 Form, we shared all of the essential details. There is a appropriate procedure to complete the shape and who each one is needed to fill this type. Book the next connect to learn more about W9 Form.

Do you want to share your ideas around the W9 form using the IRS? Please share your ideas within the comment section below.