What is the relationship between risk and return in investing? This will help you make better investment decisions by understanding the relationship between risk and return.

We all know there are many asset classes, such as bonds, gold and equities. It is crucial to know how to distinguish these assets in terms of risk and return when we have them. It will help you adjust your target and investment process.

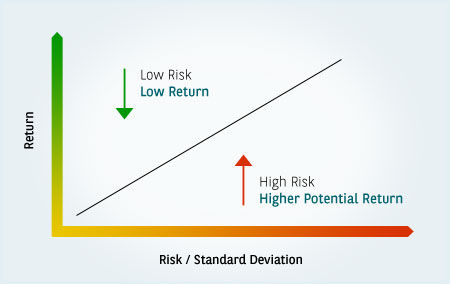

Economists know that there is no “free meal”. This means that any investment with a high return comes with significant risk. Any safe investment will have a low return. This is known as the risk-return ratio.

Return and risk: What’s the relationship?

Diversifying your portfolio means that you combine several investment instruments in order to reach your goal. Is the right investment mix right for me? The two main factors that influence investment decisions are risk and return .

The expectation of your investment’s return or yield is called “return” or “yield”. Risk is when the actual return is less than anticipated. Risk is simply the level of volatility that comes with an investment.

There are four types of main asset classes

- Equity: Also known as ownership of a company or shares, equity is a type of investment.

- Bonds: Investments like debt. You can buy a bond to give money to a company or government. In return, you get interest. You will also receive the initial capital back at the end of the time.

- Alternative Investments: These include investment in property, commodities and gold. This asset class can be more risky than bonds and equities. However, the expected returns are more predictable than those of equities or bonds. This asset class is ideal for diversification.

- Cash: That’s right, cash. Cash is a liquid investment that can be used for short-term purposes. Because of their ease of access, banks can hold short-term deposits.

This risk-return pairing is important

Investors will only accept greater risk in return for higher expected returns. Investors who want to increase the profitability of their portfolio must agree to take greater risks.

Each investor is different each investor has his own view of the “optimal” risk/return balance

How much money is saved will also affect the risk behavior. An investor who has a large amount of savings may be able to invest a portion of their total funds in risky investments. If the savings level is low, it’s better to invest in safe, but low-yielding investments.

The least risky assets on the financial markets are bonds issued in certain countries, such as France, Germany, or the United States to pay their public debt.

Volatility

Volatility is an important aspect of assessing risk.

Volatility is the change in price of financial securities, such as stocks, bonds, and currencies. The more volatile a stock is, the more sensitive it will be to positive and negative news about the company. High volatility is a sign that the stock’s price fluctuates significantly, and thus the risk associated to its value is high. Stock prices are more volatile than bonds. However, statistical studies show that stock volatility is reduced with time. Long-term holding lowers risk.

The risk premium

It’s the difference in yield between a government bond (or a stock) and a more risky investment, like a corporate bond or stock. It is, in other words, the extra remuneration offered to an investor to make him agree to purchase these bonds or shares instead of subscribe to government bonds. Bond yields are directly comparable to government bond yields. Because the risk of default is higher for the borrower, the bond yield is always higher.

The evolution of interest rates will determine the price an investor will receive if he wants to sell his bond prior to maturity. It will lose its value if rates rise, as it has a lower yield than other bonds.

Equities are traditionally thought to perform better than bonds over the long-term because they carry more risk.

The more difficult a company is the higher the probability that it will not be able to repay its debts (bonds) and generate profits (shares). As a result, its bonds are less expensive as well as its shares. .

Historical analysis of stock returns in the United States shows that there is a real, i.e. Inflation-adjusted annual returns, including between 6.5% to 7%, are much higher than long-term government bond yields (1.7%). This is the risk premium.

Comparing, as this study does, almost two centuries (XIX the andXX the centuries), the annual returns on stocks and bonds shows that there is a wider gap between the best stock performance and the worst bond yields. This would prove that equities are more profitable and less risky than bonds.

The paradox of actions

Numerous studies have shown that stocks do not pose a greater risk than bonds over the long-term, but they provide a higher return.

This principle states that the good years will outweigh the bad. Stocks would be less risky than bonds in the long-term and could be suitable for even the most cautious investors. However, the greater return on equity could be explained by the possibility of total market collapse. But bonds had lower profitability than equities in all of the disasters that were examined.

Stocks are not more risky over the long-term, despite offering a higher return… but it is important to be protected against short-term failures. A variety of investments is the best way to make sure you have enough. portfolio . This will reduce the risk level and, undoubtedly, the expected average return. However it allows for a higher return rate while maintaining its “level of risk avoidance”.

The length of the placement

Numerous studies from INSEE have shown that the likelihood of making a profit increases with the length of an investment. Furthermore, the risk of losing money is reduced if the investment period is extended. Although this can reduce the chance of a high peak gain, it is possible to lose.

These findings are as solid as they may seem. However, they are based on past statistics from the medium and long term, which in no way allow us to predict future performance.

Ideal Investment Portfolio

A balanced portfolio is one that achieves both return and risk.

Let’s say you want to buy a house in 3 years. Your savings should be available to you when you’re ready to make the down payment.

This will ensure that you maximize security and lower returns. Your portfolio might be more heavily allocated to bonds with low risk and cash than it is to equity.

You may be able to manage the risk if you are aiming for a goal within 10 years.

To maximize your returns, it is possible to add more equity to your portfolio than bonds or cash.

It is important to understand the risks and returns. You need to understand the risks involved in buying an item of high value.